Ethereum(ETH) has pushed blockchain technology to new heights, however since it’s initial creation it’s inspired the creation of other coins. Similar blockchains have arrived, with the same amount of promise, and general roadmap. In present time, I’d go as far as saying Ethereum is a great coin for other’s to look up to, but don’t mistake it as the best one out there.

After Ubiq’s testing compared to Ethereum, you might want to change your mind as to what platform you want to build upon.

What’s Ubiq?

Ubiq(UBQ) is a coin similar to Ethereum(I imagine you already know what Ethereum is), in fact it’s based off Ethereum.

Ubiq originally formed as a coin for corporations and developers to create smart contracts with, that can be ran and relied upon in a stable fashion. Due to the fact that Ethereum was constantly pushing updates, and testing new things… Users wanted something a bit more stable, and not as heavily utilized as Ethereum is.

From first glance, it appears to be a faster, less used, more stable version of Ethereum. The biggest adjustment toward the beginning of it’s life was Flux. Flux is Ubiq’s specific difficulty adjustment algorithm, that allows for block-time to maintain itself accurately.

It may seem as if Ubiq is a coin directed to attack from, or steal users from Ethereum… However, they’ve made it clear that it’s not their objective.

Benchmarking

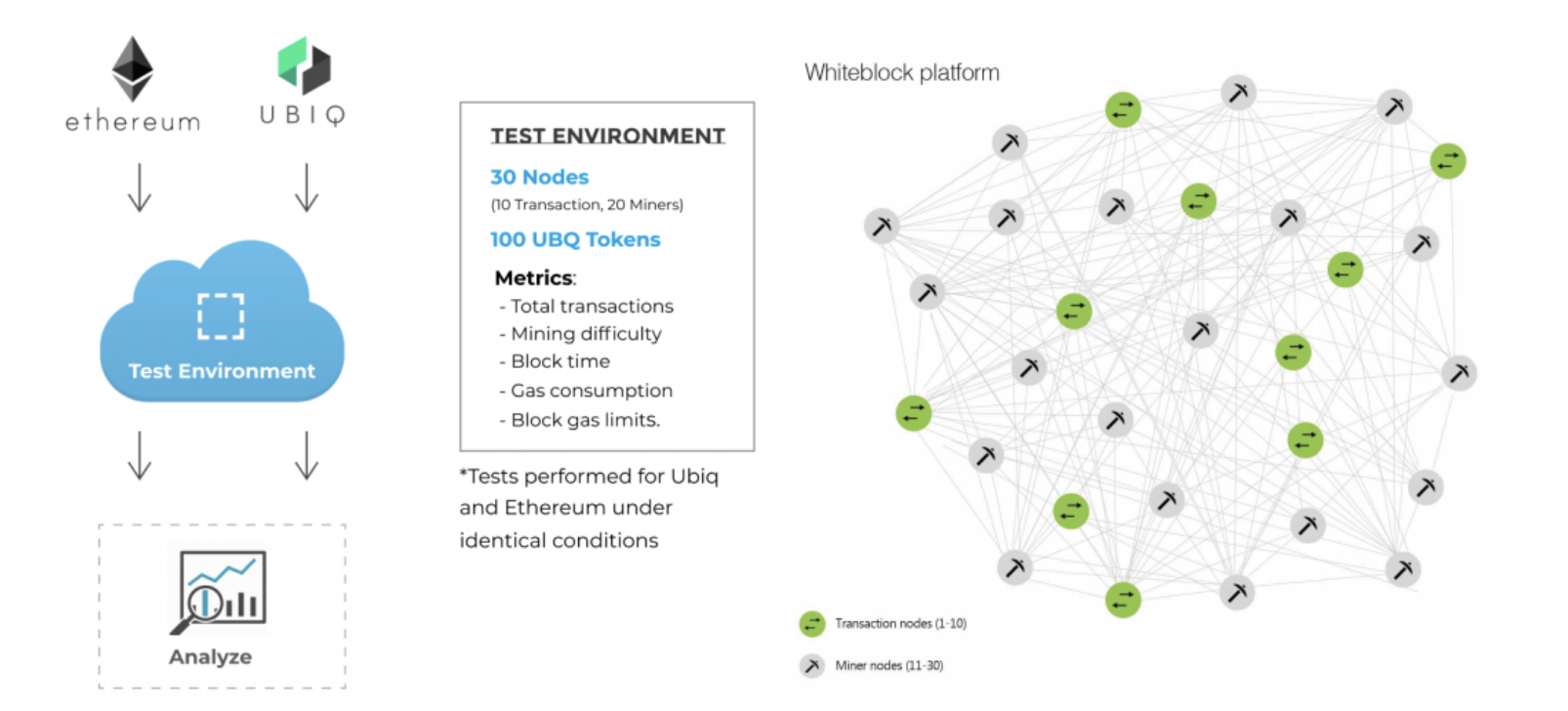

Whiteblock.io offered an opportunity to allow Ubiq to be one of the first case study’s for their Blockchain Testing as a service(BTaas). Below you can see the specifications for the test environment, against Ethereum.

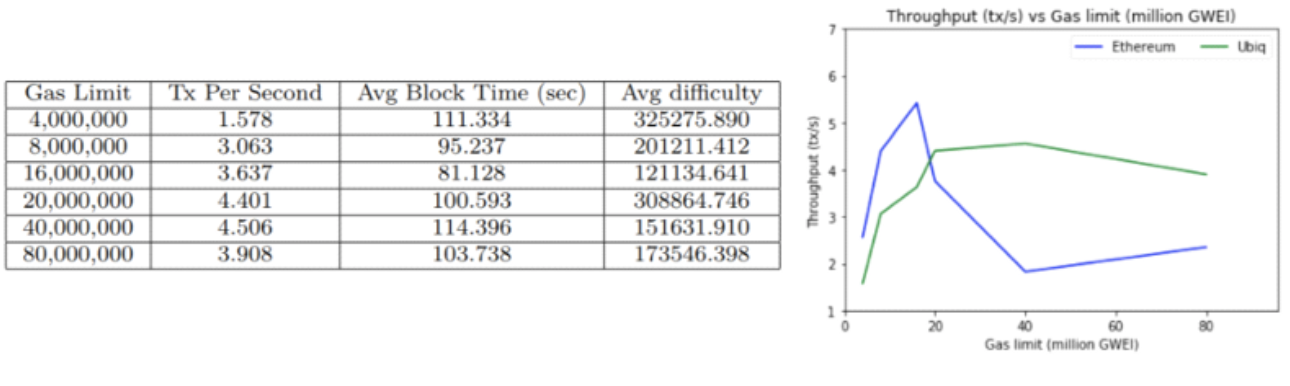

Upon each test series, the gas limit had increased… Starting at 4 million, and moving up to 80 million.

For a full breakdown of the test results and whatnot, check out the Whiteblock case study, here.

Test Results

The benchmark had revealed astonishing results. After analysis of the graph, we can spot that Ubiq has a potential for 2x transactions per second in throughput, compared to Ethereum. Additionally, at an 80 million block gas limit, Ubiq has a 90% lower uncle rate.

Uncle Rate: A measure of overall network security, the lower the rate… The less likely the transaction is false/flawed. Additionally, a lower uncle rate allows for a higher level of transaction throughput.

Conclusion

The results don’t lie. Ubiq is outperforming Ethereum, when it comes down to uncle rates, and throughput at 20 million – 80 million gas per block in an equal, and fair testing environment.

At the end of the day, Ethereum will always be the base that Ubiq relies on. However, it’s interesting to see how they both compare, and appeal to different audiences(particularly contract creators).

If you’re looking for the full test report, head on over to the full breakdown, here(mentioned above).

The Ubiq team holds a great relationship with those of Ethereum. It’s important to remember(as stated above), Ubiq has no intention of replace Ethereum, or competing directly with them.

2 Comments

Gerald Kurhl · September 17, 2018 at 4:41 am

Interesting. I wonder if Ubiq will remain Proof of Work once Ethereum implements Proof of Stake. I guess this remains to be seen.

Sid Engel · September 17, 2018 at 4:56 pm

That’s a great question. That’s a toss-up, considering Ubiq is about stability, however generally follows Ethereum’s footsteps. I imagine they’d keep POW(Proof of Work).