The fresh release of an ASIC machine can either be good, or bad for a blockchain’s economy and overall health.

Due to the release of the Bitmain Z9, I’ve been seeing this topic appear once again, and I figured it was a good time to do a write-up.

What Is An ASIC?

When it comes to Cryptocurrency mining, an ASIC(Application Specific Integrated Circut) is a computer that’s designed specifically for mining a specific coin or algorithm. Unlike your standard desktop or mining rig, these devices can’t be used for anything other than mining cryptocurrency. However, they can do it far faster than any other standard computer, at a fraction of the electricity consumption.

How much better?

Let’s get down to the numbers.

A standard 6 card(GTX 1080) rig will produce roughly 3,300 Sol/s(Solutions per second), while consuming somewhere in the neighborhood of 1100 Watts of power.

Bitmain’s new Equihash miner(more info here), claims to deliver a shocking 10,000 Sol/s, at a power consumption of only 300 Watts. It also costs half the price of a standard mining machine…

What Does The Release Of A New ASIC Do To Blockchains?

Upon the release of a new ASIC for a previously non-ASIC algorithm, a coin using said algorithm will undergo some extreme changes.

Difficulty

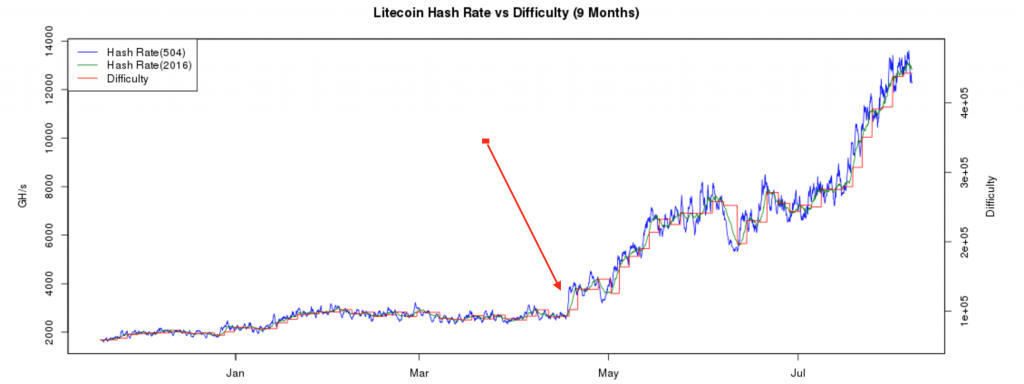

(Litecoins difficulty upon the release of it’s first ASIC machines)

Since the network will undergo the addition of lot’s and lot’s of new hash power, the mining difficulty will increase. This will make it more difficult for miners with less hashing power(all of the GPU miners) to solve and confirm transactions for the blockchain. This will also result in a destruction of the profitability that the GPU miners had previously seen.

Network hashrate as aforementioned will also sky-rocket. This can cause transactions to be completed faster than they had been before(with the GPU miners). It will also likely eliminate transaction backup, which occurs when the network can’t keep up with it’s high amount of transactions.

Centralization

Due to the fact that GPU’s are easy for just about anyone to purchase, the hash power of the blockchain is spread across many different miners.

Monopolization

Once the machines required to mine(and actually make profit) are acquired or created by a single party, they’re practically in control of who get’s to mine(efficiently), and who can get a hold of said machines.

They in theory, effectively own 100% of the market for those who are interested in mining.

Additionally, If a single party mass produces ASIC machines, and uses it for themselves, they could potentially become more than 51% of a desired networks hashing power… Which leaves the network vulnerable to a 51% attack.

What’s a 51% Attack?

A 51% attack is when a single party creates and sends a false transaction within the network. Since they are in control of more than 50% of the hashing power, they can convince more than half of the blockchain that the transaction is true, thus pushing it through.

This all sounds awful, right?

Don’t worry! The threat of centralization, and a 51% attack can really only happen with incredibly small blockchains, and also require a large investment for someone to successfully pull off.

The profitability for someone to complete a single blockchain take-over is typically not worth it.

Panic

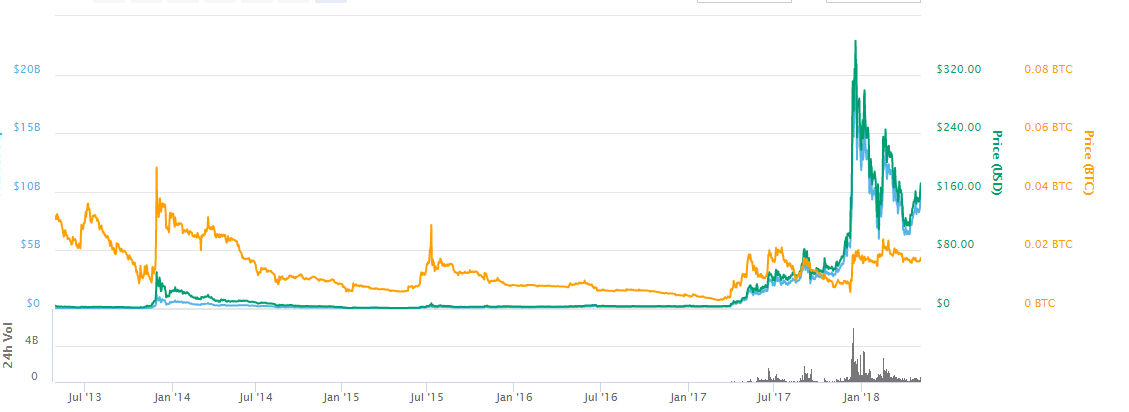

(Litecoin’s price spike, regarding the arrival of ASIC machines)

Once the ASIC’s are released, all of the coin’s supporters and miners typically break out into a panic. Knowing that there’s a chance of a 51% vulnerability, and your machines profitability eating dirt can be scary for investors… Or the thought of optimization for the network can bring in the interest of new investors.

The release of the ASIC can either have no effect on the coin price(who knows!?), or send it to the ground, or moon… Which typically causes… More panic.

There are those that think an asic release is “the end”…

Seriously tho. If I had nvidia or amd stock.. i’d be selling that shit lol… GPU mining is dead. Bitmain has been nice enough to let us in on the secret haha. – /u/crafty_clark

And those that “Aren’t in their first rodeo”.

I have mixed feelings about asics and coins forking. FWIW, I don’t own any asics and I have a pretty decent size gpu farm but I feel like decentralization and crypto was meant to let the market run itself without interference/manipulation. Forking to a different algo because an asic comes along puts power in the hands of devs. I’m fine if it does happen because I’m selfish and would like to keep mining equihash coins with GPUs but things will evolve naturally and people will move to mining other coins. – u/amalgamatecs

How Can A Blockchain Benefit From ASIC’s?

Without a doubt, the initial addition of ASIC machines to a network will cause damage.

ASIC’s believe it or not, can be good once the initial growing pains are done with.

They allow for blockchains to handle far more transactions than previously possible, and allow for the entire network to function much more efficiently.

Transaction Cost Reduction

Once ASICs are in play, the power required to approve each transaction is dramatically reduced(for the miners, as well as on a global scale)… Alongside this, depending on the blockchain, the transaction fee(miner fee) can often be reduced also.

Transaction Speed

Need I say more?

Network Expansion

No matter what, there will only be so many people interested in mining. If each of these people are mining with better equipment, the network will be able to handle more transactions… Which with some coins(Bitcoin for example), is crucial. In order for a coin to have proper adoption, and usability, the network 100% needs to be able to keep up with it’s transactions. Sometimes, ASIC creation is the only way to make this happen.

Litecoin’s Success Story

There aren’t many coins that have survived the growing pains of ASIC’s… But those that have, are thriving bigger and better than anyone could have previously imagined.

Litecoin is Bitcoin’s little brother, and just like Bitcoin… It had underwent an ASIC revolution.

For the longest time Litecoin was a GPU/CPU only blockchain, and it had functioned fine until the network couldn’t keep up with it’s large amount of transactions.

Once the Scrypt(Litecoin’s Algorithm) miners came out and were for sale by multiple manufactures, the GPU miners were practically kicked off the network and replaced.

In modern times, if Litecoin had not underwent it’s ASIC revolution it would have fallen on it’s face… As it would fail to maintain it’s key features over Bitcoin(speed, low fee’s, etc).

In Conclusion

The answer to the debate is simple. ASIC’s are great for blockchains that are in need of expansion, however can be damaging to networks that aren’t ready for it yet.

The initial addition of ASICs to a network will cause damage, but if the network is in need of expansion, it will recover and prosper like never before…

Once there are multiple ASIC manufacturers the risks of centralization and possible 51% attacks are minimized to a pulp.

The creation of an ASIC is not the end of GPU mining. GPU miners will always prosper, where ASIC’s aren’t created yet. Think of it as a never-ending chase.

0 Comments